What vending machines say about Colorado’s cannabis industry

It's more about innovation than automation

Jonathan Rose, 19 hr ago

Welcome to the first edition of Regulated State — a newsletter hyperfocused on Colorado’s cannabis industry and its burgeoning psychedelics sector.

NOTE: Please do read past the lead story for an important update on medical cannabis legislation currently being debated at the Legislature.

I’m Jonathan Rose, the editor who built the cannabis beat at the Denver Business Journal, and I’m excited to publish this biweekly newsletter that looks beyond the Denver metro and across the Centennial State (you know, the one that did it first).

As I did my due diligence over the past months, gauging the appetite for a newsletter like this, the No. 1 question that came up was “Who is your audience?”

Well I can’t say for sure — the response to the first few newsletters should give me an indication. But let me make this clear: I want EVERYBODY.

I think there are stories happening in cannabis every day with mainstream crossover appeal — I proved it at the DBJ, and I hope to do it again here.

Oh! And feel free to send me any story ideas, pitches, tips, etc. jonathan@regulatedstate.com or through Substack.

Thank you for reading/subscribing (and please forward to your friends).

-Jonathan

Like what you see? Were you forwarded this email? Subscribe below to catch the next one!Subscribe

What Terrapin’s new vending machine says about the Colo. Cannabis Industry

When Terrapin Care Station recently unveiled what it calls the “first-of-its-kind cannabis digital vending kiosk" at its Aurora location, even Gov. Jared Polis tweeted about it.

This dispensary in Aurora is the first Cannabis vending machine and the first fully automated cannabis kiosk on the market. You still need proof of ID and age to be granted entry. dpo.st/40M1UYE

The technology behind ACE (Automated Cannabis Experience), built with 50-year vending-machine vets BMC Universal Technologies, is the result of five years of development. It scans IDs; it accepts payments; and it labels and dispenses cannabis products, all in plain view. And it can hold up to 1,152 products, according to Terrapin Care Station.

But it also tells a bigger story about a Colorado cannabis industry that is slogging through probably the most challenging moment in its young life.

The big picture: The cannabis industry has entered a new reality, and nobody’s quite sure exactly what to make of it: Rock-bottom wholesale prices and dropping retail sales after a pandemic boom have left cannabis companies scrambling. Multistate operators are reducing their footprint nationwide, VC has dried up, headlines are apocalyptic.

Have the reports of weed’s death been greatly exaggerated? What local cannabis companies and analysts are telling me, though, is that this is simply an inevitable market correction — and one that was likely on its way no matter what.

Case Studies: While MSOs and VC-backed startups are laying workers off by the hundreds, Colorado retailers — and even some cultivators — are using this opportunity to innovate, and some are even expanding.

Terrapin Care Station: The Boulder-based, six-store chain recently pulled out of Michigan due to what it sees as “a serious turn,” in that state’s industry. Some 70% of Michiganders were still buying their weed on the black market as recently as late 2021, according to one study.

Terrapin employs 130 workers in Pennsylvania where it’s a cultivator, and is the only producer found on every Pennsylvania dispensary shelf, Vice President of Communications Peter Marcus told me. And it’s looking to expand with two more stores right here in its home state.

The ACE vending machine isn’t a way to cut employee headcount, Marcus said. There have been no budtender staff cuts, he said; rather, ACE is just one more way to attract customers to its stores.

It’s also a potential future money-maker, since it’s a Terrapin-developed machine that can be sold or licensed out.

And data — the currency of the new millennium — will be one way the vending machine is helping the chain adapt to these challenging times.

“We’ll learn from the type of customer who uses it,” Marcus said, pointing to sales, frequency, what type of person wants to get in and out of the shop with minimal interaction.

Native Roots: “We’ve become very good at forecasting,” Native Roots Chief Sales Officer Denise De Nardi told me.

The 20-store, Colorado-headquartered cannabis behemoth onboarded a new enterprise resource planning software system and brought on a small group of consultants to help build what De Nardi calls “the foundation” of Native Roots’ new approach.

They’ve since boosted the percentage of customers under the age of 30 by 10 points (from 28% to 38%). They’re developing new products and brands for other customer segments, and ensuring their store inventory meets neighborhood demand.

And they’re doubling down on “experiential retail,” experimenting themselves with different forms of education and technology.

“It would’ve hurt us if we would’ve just continued to produce and push to the stores at the same level,” De Nardi said. “We’re really aligning product to customer demand.”

Native Roots is also looking at adding more stores to its Colorado footprint.

Veritas Fine Cannabis: Cultivators are arguably getting hit the hardest by this downturn, but that’s not stopping high-end grower Veritas Fine Cannabis from innovating.

“It’s forcing us to be a much better company and a much better brand,” Veritas President Jon Spadafora told me. “We’ve really stripped it down to the things we know will generate traffic.”

Veritas, known for its sponsorships and partnerships, has had to cut back on those types of promotions. Instead, it’s talking to retailers to figure out what draws the types of customers who will buy high-end cannabis.

It’s doubling down on its fourth annual ski giveaway partnership with Golden-based Icelantic. Customers who purchase Veritas cannabis receive a code they can enter for a chance to win a pair of Icelantic skis or a snowboard each Friday. The companies are giving away both.

It’s not only drawing consumers to cannabis retailers and upselling products, but it’s providing invaluable data about Veritas’ core customer, and how they can be better reached. It’s also strengthening Veritas’ relationship with retail stores, according to the company.

“If anything coming out of this crappy market, it’s deepening our relationships with the stores we do the most business with,” Spadafora said. “I think at the end of the day that’s a positive thing.”

The manufacturer’s take: “I think innovation on the product side is important so we’re attracting new consumers and not just fighting the race to the bottom from a price perspective,” Wana Brands Chief Marketing Officer Joe Hodas told me.

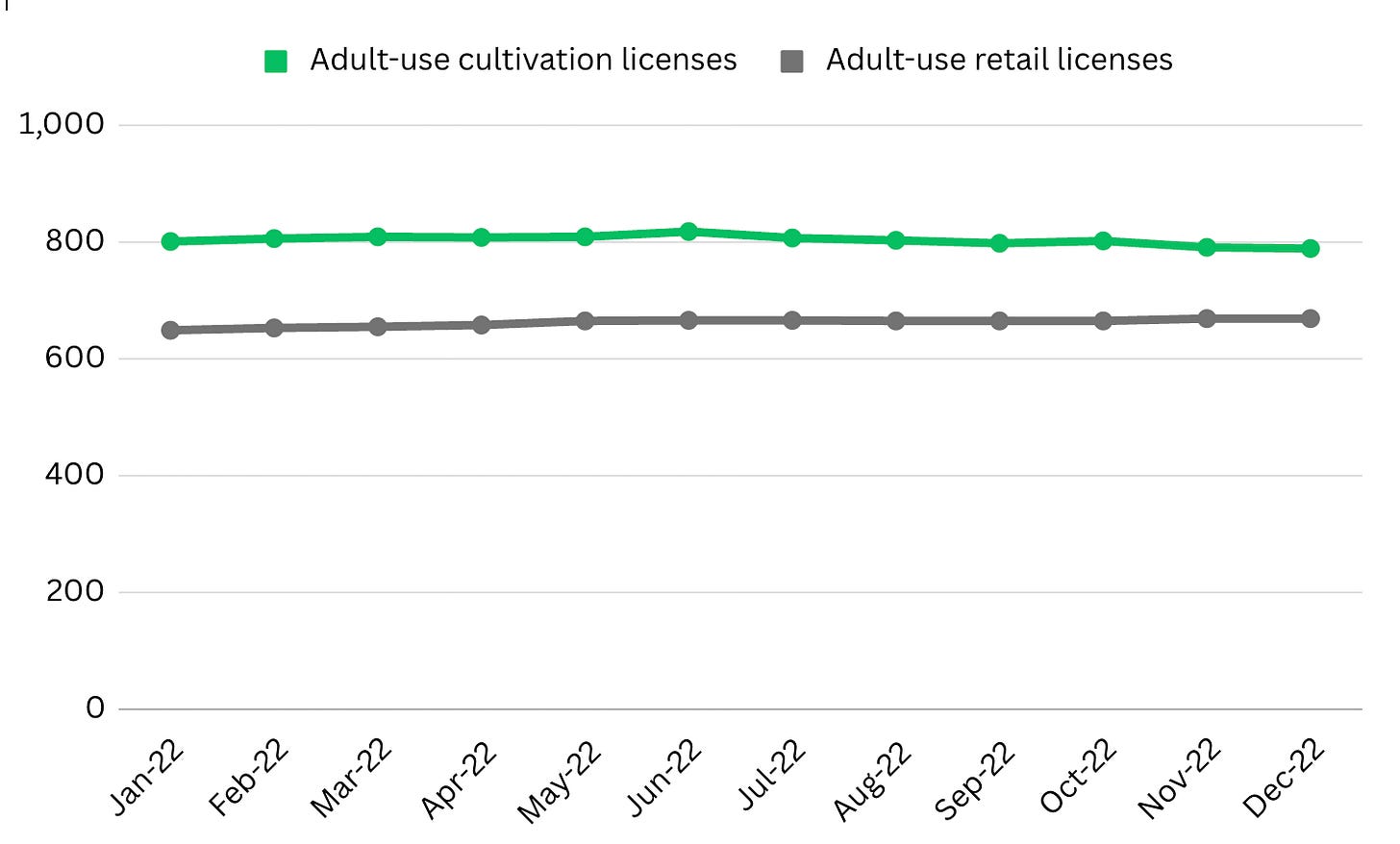

The analysis: “Colorado is undergoing a very difficult market transition as cultivators — and manufacturers to a lesser degree — react to what is oversupply in the wholesale market and rapidly declining prices that has resulted in a decline in the number of active adult-use cultivation licenses,” Vicente Sederberg Director of Economics and Research Andrew Livingston told me.

He pointed to the fact that the number of retail licenses had increased in 2022 while the number of cultivation licenses dropped slightly. And any number of those licenses could be inactive and/or up for sale.

Colorado went through something similar from 2018-2020, Livingston said. “But that didn’t occur when we were potentially facing a global recession, inflation and a significant capital crunch.”

*MED data provided by Vicente Sederberg

Truman Bradley, executive director at Marijuana Industry Group, said he sees some of the larger companies experimenting with returning to a vertical-integration model and expects various levels of success.

“I think a lot of directors of retail or general managers are having a come-to-Jesus moment about who are they, who are their customers and what do their customers want,” he told me.